It’s not often that a company name becomes shorthand for an entire technological era. Yet when people talk about the “AI boom,” they almost always end up talking about Nvidia. From gamers who once relied on its graphics cards to train their digital reflexes, to governments now tying national security to its chips, Nvidia has stepped beyond Silicon Valley into the cultural mainstream.

At its core, Nvidia is a story of transformation. What began as a niche graphics processor company has become the backbone of artificial intelligence development worldwide. Every major leap in AI — from chatbots to medical research — seems to carry Nvidia’s fingerprints. That evolution hasn’t just fueled innovation, it has also sent shockwaves through stock markets and geopolitical halls of power.

But here’s the twist: Nvidia isn’t just shaping technology; it’s shaping global conversations about money, politics, and the future of intelligence itself. Its stock movements ripple through Wall Street like cultural events, its CEO takes meetings with world leaders, and its chips sit at the heart of debates about who controls tomorrow’s AI. In short, Nvidia has become more than a company — it’s become a symbol.

What is Nvidia? More Than Just Chips

For many people, Nvidia is still associated with those glowing green logos on graphics cards that powered their first gaming PC. Yet beneath that gamer nostalgia lies a company that has steadily redefined itself. What once seemed like a brand for enthusiasts has quietly become the most important name in artificial intelligence.

The leap happened when Nvidia realized that its graphics processors weren’t just good for rendering images — they were perfect for training machines to think. Suddenly, the same architecture that made video games smoother was fueling breakthroughs in deep learning. This shift turned Nvidia from a gaming companion into a cornerstone of modern computing, opening doors into industries as far-reaching as healthcare, robotics, and self-driving cars.

Today, Nvidia is not just building chips; it’s building infrastructure for a new age of intelligence. The company’s technology underpins AI research labs, powers cloud platforms, and even sparks debates in government chambers about digital sovereignty. In many ways, Nvidia’s story reflects the transformation of technology itself — from a tool of entertainment to a foundation for the future.

Nvidia Stock: The Wall Street Darling

It’s hard to talk about tech stocks these days without Nvidia’s name popping up. The company’s meteoric rise on Wall Street has turned it into more than just a ticker symbol — it’s become a cultural shorthand for the AI gold rush. Investors watch its every move, while analysts scramble to adjust price targets as Nvidia keeps breaking records.

The fascination isn’t only about numbers. Nvidia stock has become a way for everyday people to place a bet on the future of artificial intelligence. For some, owning Nvidia shares feels less like buying into a company and more like buying into a vision of tomorrow. And like any cultural phenomenon, the stock carries both excitement and unease, reflecting the promise and risk of transformative technology.

Live stock chart of NASD:NVDA showing real-time market performance.

But beyond the thrill of headlines, Nvidia’s stock is also a mirror of broader market psychology. It tells us how investors view AI’s trajectory, how global politics shape demand for chips, and how quickly innovation translates into financial reality. In short, following Nvidia on Wall Street is like taking the pulse of the tech world itself.

Nvidia Stock Price and Market Performance

Nvidia’s stock price (NASD:NVDA) has soared in recent years, often defying expectations. From being a steady performer in the GPU market, it has catapulted into trillion-dollar territory.

Every earnings season brings anticipation, and often, fireworks. What’s striking is how Nvidia’s valuation reflects not only its sales but the belief that it sits at the center of the AI revolution.

Investor Sentiment and Futures Outlook

When analysts talk about “Nvidia futures,” they’re not just speaking in financial jargon. They’re talking about the forward-looking belief that Nvidia will remain the backbone of AI development for decades.

Futures trading captures that optimism, but it also amplifies volatility. The narrative investors tell themselves — whether of endless growth or looming regulation — becomes a powerful force shaping Nvidia’s market destiny.

Why Nvidia Matters Beyond Wall Street

It’s easy to think of stock charts as abstract lines, but Nvidia’s rise affects more than traders. Pension funds, retail investors, and tech workers all feel its ripple effects.

When Nvidia’s stock jumps, it fuels confidence in the entire semiconductor sector. When it wobbles, anxiety spreads across markets. In that sense, Nvidia stock has become a cultural barometer, measuring how society views the risks and rewards of AI.

Nvidia Earnings: A Mirror of the AI Boom

Every earnings season, Nvidia’s numbers do more than fill spreadsheets — they tell a story about where the world is heading. When the company posts double- or triple-digit revenue growth, it isn’t just a corporate victory; it’s proof that AI is no longer a distant promise but a daily reality.

The headlines around Nvidia’s quarterly reports have started to feel like cultural events, with each release dissected like a season finale of a hit show.

What makes Nvidia’s earnings so fascinating is how directly they map onto the AI adoption curve. As tech giants race to build larger and smarter models, their demand for Nvidia’s chips skyrockets. Hospitals, universities, and even governments are feeding into this surge, each needing hardware powerful enough to crunch unimaginable amounts of data. Every dollar in Nvidia’s earnings reflects a world trying to keep up with its hunger for intelligence.

At the same time, these results reveal how fragile the momentum can be. Supply chain bottlenecks, export restrictions, or sudden shifts in global policy can tip the balance overnight. Nvidia’s earnings are a reminder that while the AI boom is rewriting balance sheets, it’s also navigating a storm of geopolitical and economic currents.

Watching those numbers climb or dip isn’t just about finance — it’s about understanding how tightly technology and society are now intertwined.

In the News: Politics, Chips, and Power (Updated)

Some companies stay confined to the business pages. Nvidia, however, has moved far beyond that. From Washington to Beijing, from Silicon Valley to Wall Street, debates about chips, national security, and the future of artificial intelligence increasingly orbit around a single name, one that many now call the “AI government.”

Recent headlines make this influence impossible to ignore. SoftBank has sold its remaining stake in Nvidia to pour capital into OpenAI, capital that OpenAI will, ironically, use to buy more Nvidia chips. It’s a perfect illustration of how the company has become the central gravitational force of the global AI ecosystem.

And all this comes during a month that feels more like a full year of expansion. In September alone, the world’s most valuable company, now with an unprecedented US$4.33 trillion market cap, announced:

- A US$6.3 billion deal with CoreWeave

- A US$700 million investment in Nscale

- A US$900 million acqui-hire of Enfabrica

- A US$5 billion slice of Intel

- A US$100 billion mega-deal with OpenAI

The scale and velocity of these moves have reinforced the idea that Nvidia is no longer just a semiconductor maker, it is a geopolitical entity. Its decisions ripple across governments, industries, and global supply chains with the weight of sovereign influence.

Meanwhile, a viral video summarising 31 years of Nvidia’s history in one clip has been circulating online, reminding the world that it all began with graphics cards for gaming in the 1990s. That slow, deliberate expansion into cloud computing, supercomputing, and generative AI explains how the company became indispensable to the digital economy.

What stands out most today is the cultural and political gravity of Nvidia’s actions. Policies, trade restrictions, and diplomatic negotiations increasingly revolve around the chips that power modern intelligence. When U.S. officials debate limits on exports to China, or authorise “modified” GPUs to navigate national security constraints, the conversation stops being about hardware. It becomes a question of who controls the future.

Reading the news about chips is no longer just reading about technology. It is reading about the balance of global power itself, and few companies embody that intersection of innovation, influence, and geopolitical tension quite like Nvidia.

The Future of Nvidia: From AI Factories to Global Influence

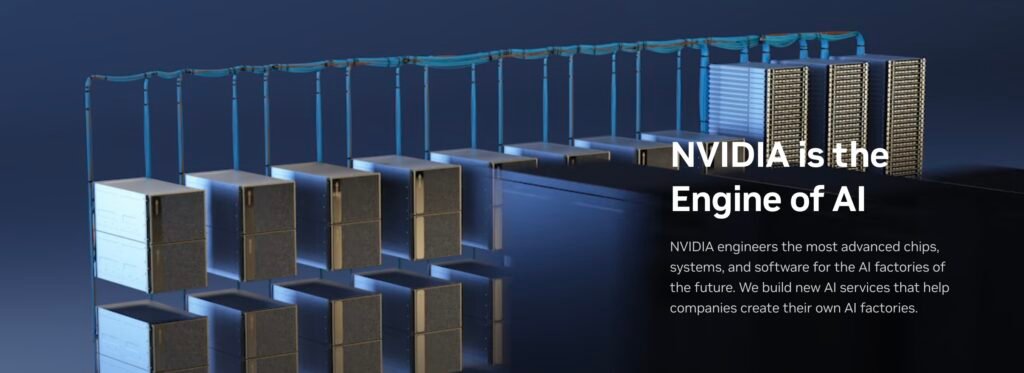

Speculating about the future of this company is a bit like speculating about the future of technology itself. Its latest breakthroughs, from next-generation chips to visions of “AI factories,” suggest a world where artificial intelligence is produced, scaled, and distributed like electricity. The company isn’t just building hardware; it’s sketching out blueprints for how societies might run their digital infrastructure in the decades to come.

This forward march isn’t confined to labs or corporate offices. It shapes how entire industries think about their place in the AI era. Education, finance, healthcare — each sector is reimagining its future around the computational power this firm provides. In this way, the company acts less like a supplier and more like a cultural architect, embedding its technology into the very DNA of tomorrow’s economy.

Yet with influence comes scrutiny. As governments, regulators, and rivals wrestle with the consequences of its dominance, questions of accountability, transparency, and global balance rise to the surface. The future here isn’t just about faster chips or higher stock prices; it’s about the societal bargain we make with a company that increasingly holds the keys to digital progress.

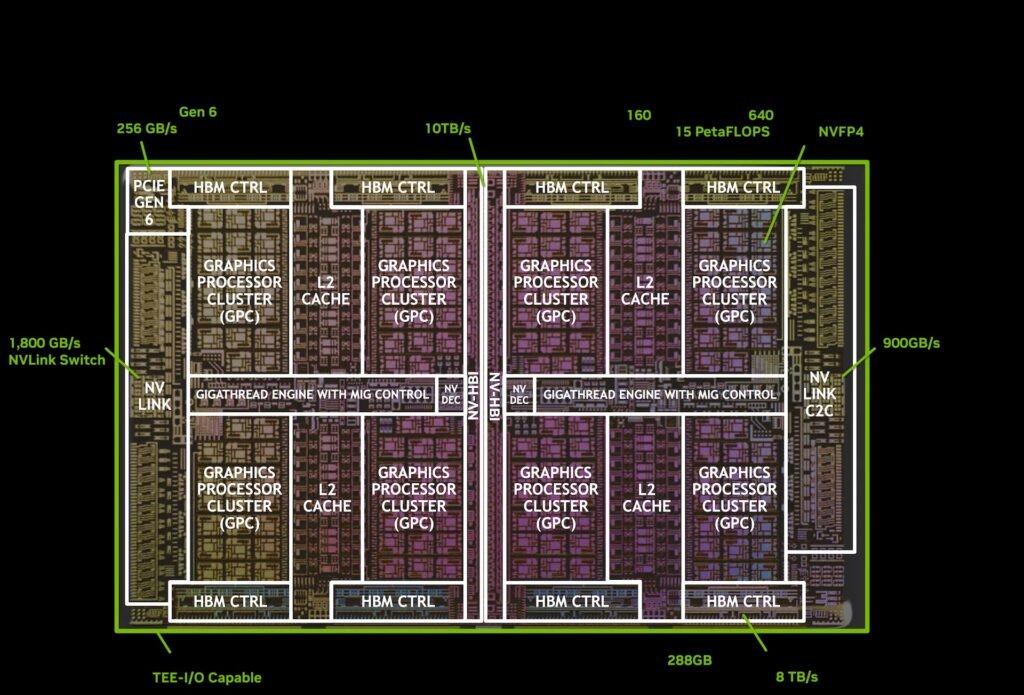

AI Factories and the Blackwell Ultra Era

The introduction of the Blackwell Ultra chip represents more than technical advancement — it’s a declaration of intent. By positioning its hardware as the foundation for AI factories, the company envisions a world where intelligence is mass-produced. This concept could reshape everything from data centers to global supply chains, effectively creating the industrial backbone of artificial intelligence.

Global Reach and Cultural Influence

Beyond technology, the company’s reach extends into diplomacy and culture. Its executives meet with presidents and policymakers, while its products define the pace of innovation in classrooms, research centers, and creative industries. The future influence here isn’t just about performance benchmarks — it’s about how a single corporation becomes a reference point for what digital progress looks like across cultures and continents.

The Road Forward

Looking ahead, this company’s journey is no longer just about semiconductors or stock charts. It’s about how deeply one firm can shape the narrative of technology, finance, and culture all at once. Few businesses carry the weight of being both a market darling and a geopolitical chess piece, yet that dual role now defines its identity.

For investors, the road forward will mean watching the balance between growth and regulation. For policymakers, it will mean deciding how to manage a private company that has become a public asset in matters of national security. And for everyday people, it will mean living in a world increasingly powered by technology born from its chips, whether they realize it or not.

Ultimately, the story here is a reminder that innovation never happens in isolation. Every leap in processing power ripples outward — into classrooms, trading floors, and government chambers. The company’s next moves will shape not only the trajectory of artificial intelligence but also how societies adapt to a future where intelligence itself feels like an industrial resource. The road forward is as thrilling as it is uncertain, and that’s what makes it a story worth following.